what is hospital indemnity high plan

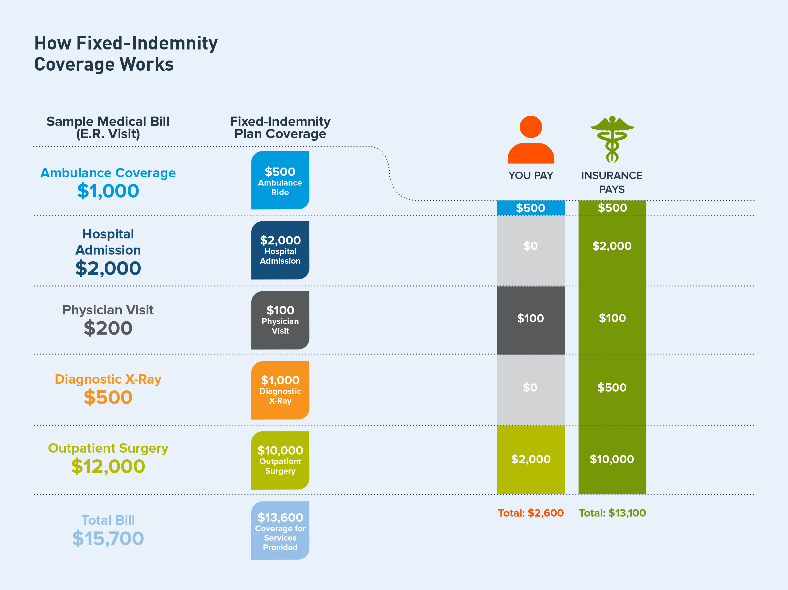

That means that that you can combine a Fixed Indemnity Hospital Plan with a traditional high-deductible plan in order to cover medical expenses before reaching the. Hospital indemnity insurance supplements your existing health insurance coverage by helping pay expenses for hospital stays.

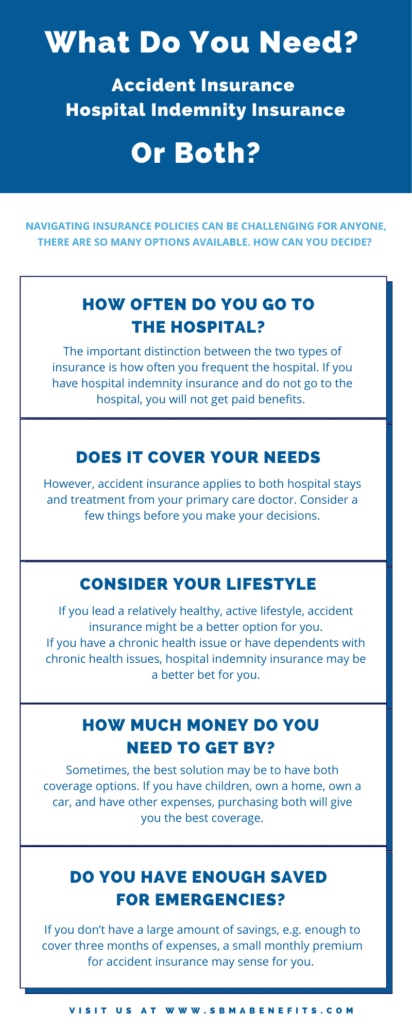

Hospital Indemnity Vs Accident Insurance Sbma Benefits

Guaranteed acceptance for you and eligible family members 2.

. Hospital indemnity insurance is a type of policy that helps cover the costs of hospital admission that may not be covered by other insurance. A hospital stay can be expensive and can happen at any time. And the cost is 399 per month which is 253 less than your current plan.

Gain peace of mind amidst high healthcare costs. Hospital indemnity plans are especially beneficial for those with high deductible insurance plans. Every hospital indemnity insurance plan is different but Aflacs hospital insurance pays the.

The coverage your hospital indemnity insurance provides will depend on your plan selection. Hospital Indemnity plans are typically paid for on a monthly basis. Conversely a 55-year-old family man with a 250-per-night plan may settle up to 40 or more.

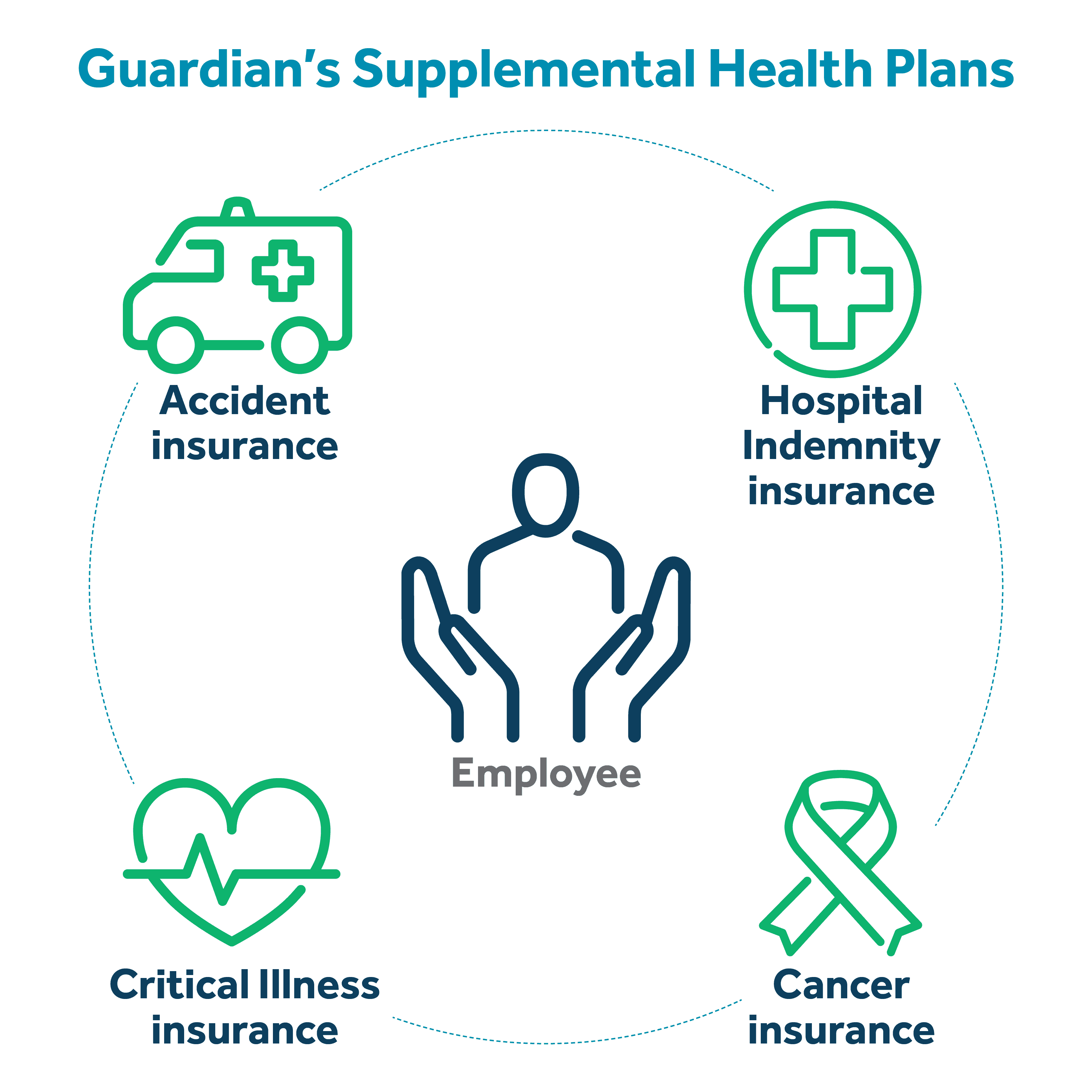

Peter Kuzniewski was born with a congenital hand deformity called bifid or duplicated thumb. For complete details of the best plan for you and your family talk to your companys. The supplemental plans listed below can be applied for individually and premiums can be paid on.

Health insurance plans are offered andor underwritten by Aetna Life Insurance Company Aetna. Even with medical coverage out-of-pocket expenses such as deductible costs rehabilitation and transportation can add up quickly. Hospital confinement with or without surgery Intensive Care Unit ICU confinement.

It wont pay medical bills from your doctors or hospitals nor will it pay for your medications from the pharmacy. As an additional option you can likely use it to pay any. You dont think you can downgrade.

Depending on the plan hospital indemnity insurance gives you cash payments to help you pay for the added expenses that may come while you recover. One hospital indemnity plan we work with contains a 6350 lump sum hospital admission benefit and a daily hospital benefit of 200 per day. Prepare for the unexpected with a Hospital Indemnity Insurance policy.

This scenario illustrates 1100 for First Day Hospital Confinement and 100 for Daily Hospital Confinement for days 2 and 3. Since hospital indemnity insurance is a sum of money paid to you relative to the terms of your plan providers cannot deny your insurance. Optional benefits like coverage for medical-related travel expenses or expenses incurred for family care.

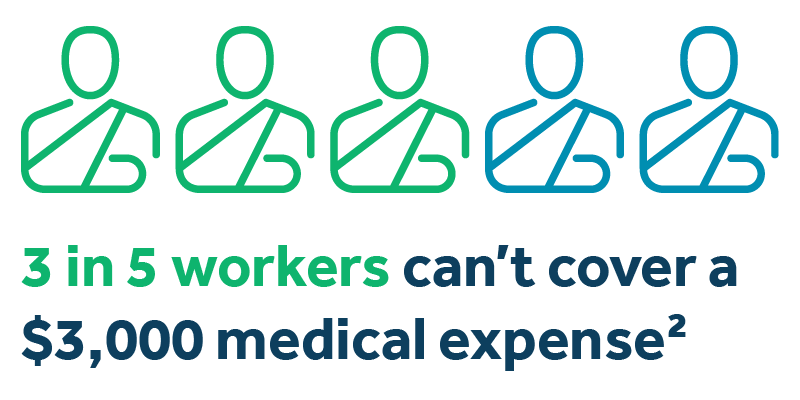

The benefits may vary from the coverage your employer is offering. For instance a 30-year-old individual with a 100-per-night hospital indemnity plan can hope to pay under 5 each month to look after coverage. As deductibles co-pays and co-insurance rise many employees are worried about increasing out-of-pocket costs.

For example Monday-Tuesday 1 day Tuesday-Wednesday 1 day. Critical Care Unit CCU confinement. Every hospital indemnity insurance plan is different but Aflacs hospital insurance pays the policyholder cash benefits unless otherwise assigned.

Hospital indemnity insurance is meant to supplement your medical insurance not replace it so its as important to understand what it wont cover as what it will. Some plans offered by Health Benefits Connect can be purchased by a simple online application without medical underwriting. To learn more about hospital indemnity insurance and ask specific questions call 888-855-6837 to speak with a licensed agent.

If you currently offer or are considering moving toward a high-deductible health plan Hospital Indemnity Insurance is a cost-effective way to. Same-day appointments are available for patients who are in need of acute care. You pay a monthly.

The average price of a hospital stay for seniors is nearly 15000 for a five-day visit. Some hospital indemnity coverage also. That means its designed to complement traditional health.

But you can with hospital indemnity insurance. We offer both HSA 5 and non-HSA-compatible HI plan designs. Typically plans pay based on the number of days of hospitalization.

Additionally you can receive 3000 lump. If you are looking for extra financial protection against the unexpectedly high costs of hospitalization then a hospital indemnity plan may be worth considering especially if you have a high-deductible major medical plan. Premiums increment as policyholders age and add relatives.

Hospital indemnity insurance is an insurance plan you can purchase in addition to your health insurance plan sponsored by your employer the government or a private insurer. If you currently offer or are considering moving toward a high-deductible health plan Hospital Indemnity Insurance is a cost-effective way to round out your coverage options. Your individual experience may also vary.

Portable coverage should you decide to leave your current employer 3. In general most plans cover. While Medicare may cover some of this it wont cover the entire cost.

So lets say you have a 6500 deductible on your health insurance plan and are responsible for 30 coinsurance. As part of our base plan our guaranteed issue 4 Hospital Indemnity HI insurance provides a competitive range of first day confinement and daily confinement benefit amounts. Medicare Advantage Part D and MedgapSupplement plans.

Also known as hospital confinement indemnity insurance or simply hospital insurance it is considered a type of supplemental health insurance. For language services please call the number on your member ID card and request an operator. These plans can still help financially protect you if youre faced with high hospital bills.

It provides a fixed benefit amount to help cover expenses and. A day is 24 hours and indicates an overnight stay. Please feel free to call us at 866-966-9868 if you have questions about Hospital Indemnity Plans.

Hospital Indemnity insurance can help lower your costs if you have a hospital stay. If you stay overnight at the hospital your indemnity insurance will payout the pre-set amount. Hospital expenses average nearly 4000 a day with a typical hospital stay costing more than 15000 total.

However there are plans that cover even more. You may choose to use the benefit payments you receive from a. Health benefits and health insurance plans contain exclusions and limitations.

The UnitedHealthcare Hospital Indemnity Protection Plan is insurance that pays a lump-sum benefit directly to a covered employee after a hospital stay and related expenses. Its a pretty black and white arrangement. Coverage for hospital admission accident-related inpatient rehabilitation and hospital stays 1.

Hospital indemnity insurance helps by putting recovery first over hospital bills. What is hospital indemnity high plan Sunday March 13 2022 Edit. Hospital Indemnity Insurance is a policy that pays you a fixed cash benefit for hospital admittance and in-patient services.

A hospital indemnity plan can work for most people. Essentially hospital indemnity insurance can help provide protection or.

Business Man Drawing Insurance Concept At Office Sponsored Advertisement Ad Man Office Concept Business Business Man Drawings Concept

Hospital Indemnity Insurance The Hartford

The Value Of Hospital Indemnity Insurance L Guardian

Kemper Health Hospital Indemnity Insurance

4 Facts You Need To Know About Hospital Indemnity Insurance

Kemper Health Hospital Indemnity Insurance

What Is Hospital Indemnity Insurance And Do I Need It American Income Life Insurance Co

Professional Indemnity Insurance Professional Indemnity Insurance Indemnity Insurance

4 Facts You Need To Know About Hospital Indemnity Insurance

Why Hospital Indemnity Insurance Should Be Part Of Every Coverage Portfolio Allstate Benefits

How Hospital Indemnity Insurance Works Guardian

Health Insurance Cover Is Surely Both A Short Term And Also Lasting Investment Prior To Individual Health Insurance Best Health Insurance Life Insurance Sales

Dangers Of Fixed Indemnity Plans But Not In The Eyes Of The Court Triage Cancer Finances Work Insurance

The Value Of Hospital Indemnity Insurance L Guardian

Sun Life Offers Hospital Indemnity Insurance With New Extended Hospitalization Coverage To Help Members Close Coverage Gaps Sun Life